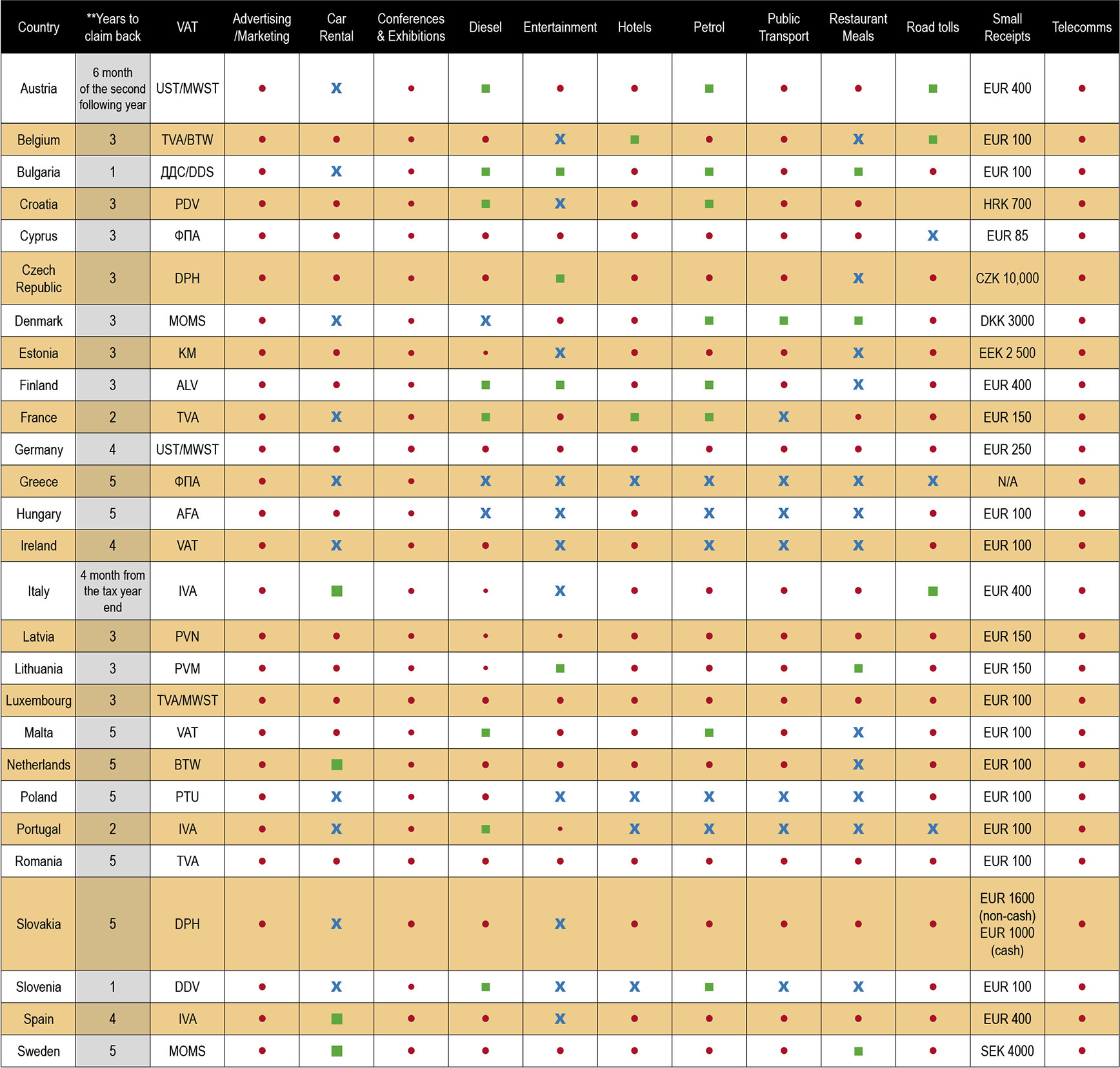

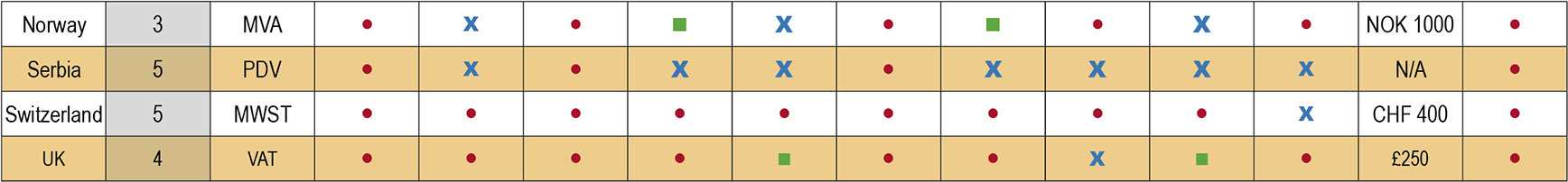

Optimise your VAT savings for domestic business travel and expenses with our automated state-of-the-art VAT recovery service.

Domestic VAT reclaim is the process of recovering your companies local Value Added Tax incurred on local business travel expenses, MICE related expenses and some other non-travel-related expenses such as Office stationery and supplies. The VAT can be reclaimed every quarter or every month and in some regions can be reclaimed going back up to five years.

Indicates that VAT is deductible.

Indicates that VAT is deductible. Indicates that VAT is deductible subject to certain conditions being met.

Indicates that VAT is deductible subject to certain conditions being met. Indicates that VAT is non deductible.

Indicates that VAT is non deductible.